My Tried And True Method Of Selling Clients On EMV

By Mark Paley, MBA, Director of Partner Sales at Cardknox

The EMV liability shift happened October 2015, yet 63 percent of merchants are still not EMV ready. The cause for much of this may be the perception of added expense or misconceptions about the ramifications. However, card present merchants that are not utilizing chip readers are losing out in a significant way.

The shift created the opportunity for developers and software resellers to sell higher margin solutions and allowed them to develop relationships with their merchants as experts and trusted advisors. However, the main benefit of EMV pertains to merchants.

EMV provides a bolstered level of security with tokenization and the added difficulty of duplicating cards. These are all peripherals in comparison to the main benefit of EMV, which is that chargeback liability is the responsibility of the issuing banks. Since October 2015, merchants processing swiped transactions were liable in the event of a chargeback. When a merchant migrates to an EMV-capable system, chargebacks remain the burden of the banks issuing the cards.

By educating merchants on the actual cost of chargebacks, EMV suddenly becomes a very real priority for them. What typically works best for us, and what I train my sales people and clients to pitch, is the following.

Chargebacks Are Expensive

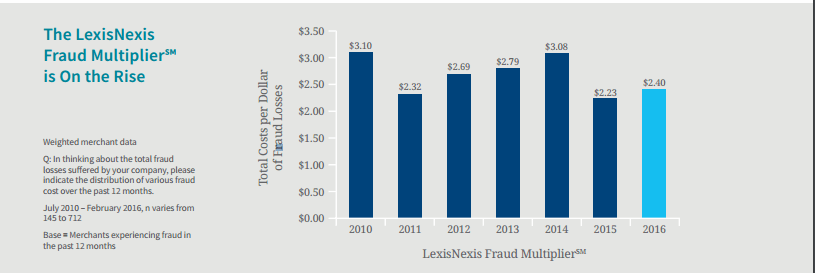

According to the Lexis Nexis 2016 True Cost of Fraud study, illegitimate chargebacks cost merchants an average of $2.40 per dollar. In other words, every dollar charged back costs merchants $2.40 from a combination of fees, overhead expenses, and merchandise replacement. That cost is growing with merchants reporting an 8 percent increase in chargeback costs this past year alone.

Chargebacks Are Commonplace

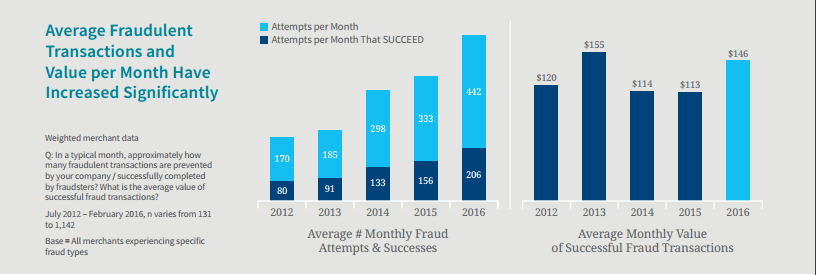

With EMV making it more difficult for card-present transactions, fraudsters have gotten desperate. Since last year, the number of monthly chargeback attempts has grown one-third. Merchants are reporting fraudulent chargebacks to have cut into a distressing 1.5 percent of business revenue.

EMV Implementation Can Be Painless

Merchants using the right service provider should not have trouble switching to EMV. Cardknox offers advancing integrations that provide solutions for developers and resellers that allow merchants to remain with their current systems and seamlessly migrate to EMV acceptance. Whether it’s a POS system, a cloud-based setup, QuickBooks integrations or CRM communications, Cardknox has solutions that assist developers and resellers to craft as value-added EMV proposal.

EMV Can Be Low-Cost

It is possible for EMV to be implemented inexpensively, as long as developers and resellers are working with the right service provider. Merchants using Cardknox do not necessarily even need to purchase new equipment, as many cases allow a simple reprogramming for a nominal cost. Cardknox works with merchants at any price point to migrate them to EMV standard.

Developers stand to gain from Cardknox EMV as well since integration is quick and straightforward. A few hours and ten lines of code may be all it takes to have your merchant running a live EMV transaction.

In summation, you can sell EMV to any merchant by challenging their misconceptions and giving them the knowledge and tools they need to begin processing safer and more efficient payments at their business.

Cardknox integration experts are available to assist with questions, solutions or strategies for implementing EMV at your merchants. Contact us today at www.Cardknox.com.

Cardknox is a developer-friendly EMV solution that can be integrated with POS systems using only a few lines of code. Offering gateway-only or integrated payments with the lowest rates and most aggressive residuals in the industry, Cardknox serves thousands of customers across every major industry throughout the United States, UK, and Canada. The Cardknox solution supports Verifone, PAX, and Ingenico terminals with PCI-validated P2PE. For more information, visit www.Cardknox.com.