From Documents To Digital Data: How To Automate Your Financial Office

Peter Braverman, Donnelley Financial Solutions

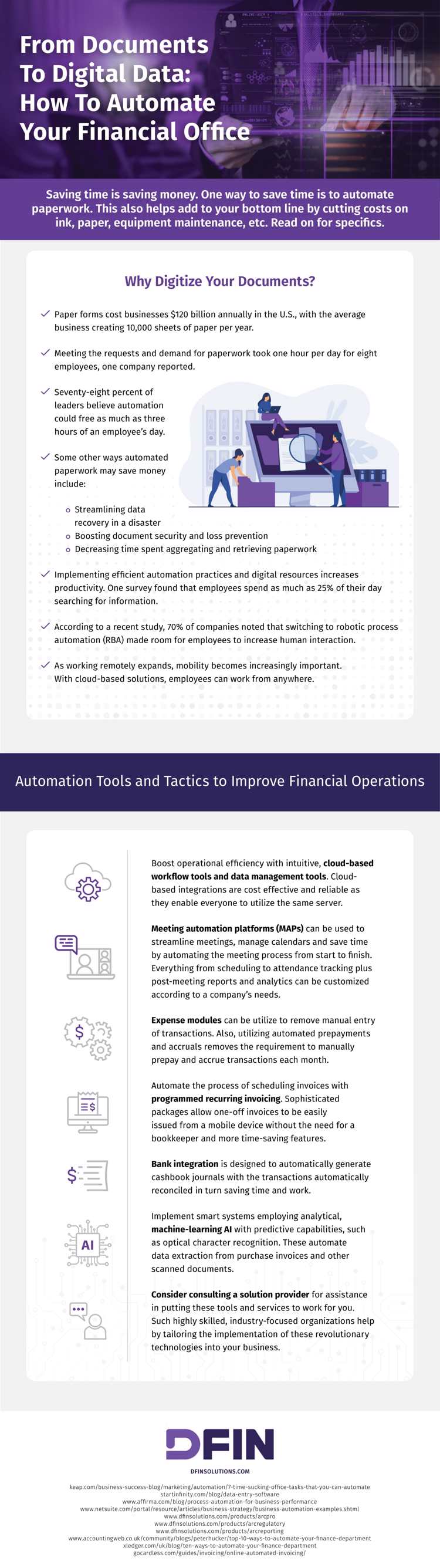

As a business owner, saving time means saving money. That’s why automating repetitive tasks that routinely occur in your offices — and, therefore, reducing the amount of time and money needed to complete each process — should be high on your list of priorities. Steps to automate your financial office can include reducing your reliance on paper and digitizing your workflow processes.

Expenses of a Paper-Reliant Office

Paper is ubiquitous in most business settings. Paper forms cost businesses $120 billion annually in the U.S., with the average business creating 10,000 sheets of paper per year. Here are just a few of the ways your office is spending money on paper.

- Cost of the paper: The price of paper increased in 2021, due to the rising costs of wood pulp (25% increase), ocean freight expenses, and gasoline prices. Contributing factors also include the decreased availability of paper due to increased demands for bath tissue during Covid, which shifted production priorities, and mill closures, caused by many paper mills’ products not being needed during the lockdown.

- Document storage: Whether you store documents in file cabinets inside your building or at a third-party location, that storage costs money. After all, unless you own your building, you’re paying monthly rent on all the space you use, whether that space holds people or paper. If you’re considering long-term document storage at an off-site location, budget approximately $1 per box of documents per month.

- Salaries for employees who handle the paper: The annual salary for one administrative assistant ranges from $34,000-$53,000. Office managers typically earn more.

Benefits of Office Automation

Automating routine office tasks offers many advantages.

- Reducing the number of steps in a process reduces the number of chances for errors.

- Standardizing practices reduces the opportunities for employees to use their own judgement when encountering a complication, which can result in an arbitrary wrong choice.

- Automating routine processes frees employees to concentrate on higher-level responsibilities, which can make them feel more valued and engaged with the company.

- Consolidating multiple software programs into one companywide software enables different departments and locations to communicate seamlessly with each other.

- Automating information streamlines data recovery after a natural disaster.

- Digitizing information increases document security and improves loss prevention.

- Upgrading to robotic process automation (RBA) enables employees to increase human interaction with their colleagues.

- Implementing digital, cloud-based solutions enable employees to work from anywhere.

- Digitizing forms reduces the time spent aggregating and retrieving paperwork.

Automation Can Improve Financial Operations

Incorporate technology to unify and standardize your financial office.

- Cloud-based workflow tools and data-management programs are reliable and cost-effective because they increase efficiency by enabling everyone to utilize the same server.

- Meeting automation platforms (MAPs) can manage employee schedules and calendars, track meeting attendance, automate the meeting itself, and create post-meeting analytics and reports that are customized to your company’s unique needs.

- Machine-learning artificial intelligence solutions with predictive capabilities, such as optical character recognition, can be incorporated. When scanned, these analytical, smart systems automate data extraction from purchase orders, invoices, and other documents.

About The Author

Peter Braverman is Vice President of Sales for Donnelley Financial Solutions™, a financial software solutions company. He has 16 years of experience in the industry and focuses on selling SaaS solutions in the Capital Markets industry.