Baby Steps: Better Planning, New Priorities Inch Partners Toward Growth

By Chris Gonsalves, vice president of editorial and senior analyst, The 2112 Group

Channel partners are realizing a small but measurable uptick in growth and overall revenue fueled in part by an increase in prudent business planning, new research from The 2112 Group finds.

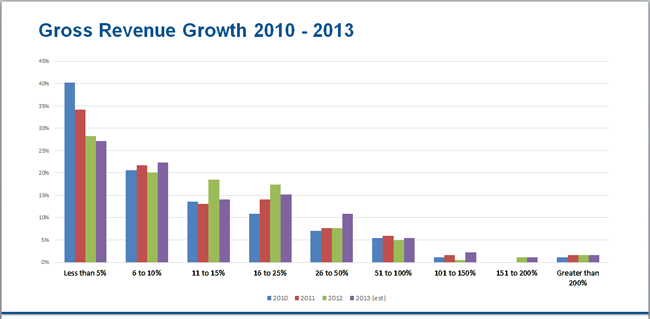

According to the 2014 Channel Forecast report by The 2112 Group, conducted in cooperation with Business Solutions magazine, more than one-third of solutions providers surveyed expect to see annual revenue growth at or above 16 percent when they close the books on 2013 (see figure 1). Around one in eight solutions providers estimated their 2013 growth at between 26 percent and 50 percent, well above the channel average of 11 to 15 percent.

In terms of optimism, expectations for beating channel norms outpaced similar estimates gathered in 2012 in all growth categories from 26 percent to 200 percent and above.

While the gains appear modest — just under one-half of solutions providers remain mired in tepid growth of 10 percent or less — the 2014 Channel Forecast shows a market that remains profitable and sustainable even in a period of generally weak IT sales and limited technology vendor innovation.

Fig. 1 (Click image to view full size)

General channel growth has been tempered by softness in the $3.8 trillion global IT market, which Gartner estimates grew just 0.4 percent in 2013 and is poised to rise a modest 3.1 percent this year. Within those figures, the $963 billion IT services segment fared little better, growing just 1.8 percent in 2013 and slated to rise 4.5 percent in 2014.

The downward pressure is worsened by vendors who weathered the global economic downturn of the last five years by slashing research and development spending, giving partners fewer opportunities for innovative technology refresh and update sales. Hewlett-Packard, for example, which once spent close to 12 percent of its gross revenue on research and development, has cut such spending to less than 3 percent, according to Bloomberg.

Despite the hardships, solutions providers are finding effective ways to grow their businesses, The 2112 Group research finds. One way they are beating their competition — and the overall market — is by getting a better handle on growth investments and engaging in increased and improved formal strategic planning. Business planning and management accountability are qualities that have eluded many solutions providers in the past.

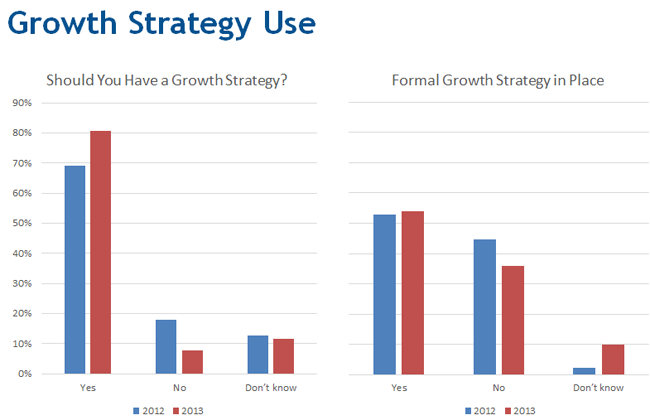

Eight out of 10 channel partners surveyed by The 2112 Group now say they feel a company like theirs should have in place a formal growth plan that sets growth targets and identifies the elements required to achieve goals (see figure 2). That strong belief in strategic planning is finally translating into action with more than one-half report actually having such strategic planning materials in place. That’s a significant improvement over 2012, when 69 percent of solutions providers said a formal growth strategy is a necessity and just 45 percent were using one.

Fig. 2 (Click image to view full size)

More important than the raw growth planning numbers are the data that show the impact such business acumen can have on the solutions providers’ bottom lines. Solutions providers with strategic plans in place outpace planning laggards by nearly two to one when it comes to the expectation of beating the market through organic growth over the next three to five years.

Solutions providers without strategic growth plans make up the bulk of partners stuck in the low-growth category of 5 percent or less per year, while the aggressive business planners best their peers in every annual growth category above 6 percent. The difference strategic plans make is seen most impressively in the 16 percent to 25 percent, and the 26 percent to 50 percent ranges, where solutions providers with active business plans more than double the performance of their non-planning peers.

The lack of business acumen and discipline is a direct cause of low growth. It hinders the performance of all in the channel, from the smallest solutions provider to the largest distributors and vendors. Even a modest improvement in the ability of partners to plan and grow their business, as demonstrated in the 2014 Channel Forecast report, is likely to pay dividends in the form of a healthier, more robust channel ecosystem.

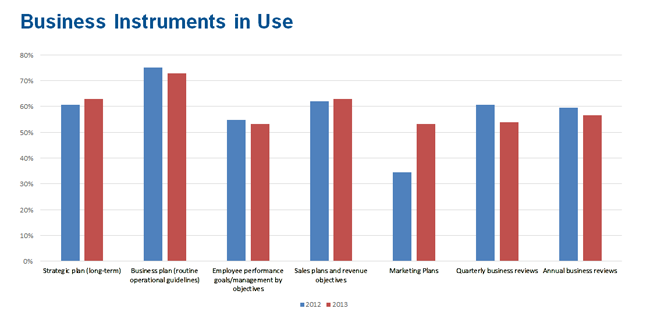

The improved attitudes about planning were reflected in the uptick in use of most typical business instruments — strategic business plans, sales plans, and revenue objectives — among those partners polled by The 2112 Group (see figure 3). The most significant increase, however, was in the use of formal marketing plans, which were in use by 52 percent of solutions providers, up from around 33 percent a year ago.

Fig. 3 (Click image to view full size)

More than just an academic exercise, these marketing plans are having an impact on the way partners are adjusting their tactics to position themselves for growth. More than one-half (56 percent) say leveraging aggressive sales and marketing is now their primary means for growth. Fewer than one-quarter of solutions providers polled in 2012 picked sales and marketing as a core growth driver, with the majority (56 percent) pinning their hopes on mergers and acquisitions to increase sales capacity.

In 2013, the M&A growth strategy has been almost complete supplanted by optimism for well-planned sales and marketing along with forming new partnerships with vendors to expand offerings, which topped the list for one out of four solutions providers.

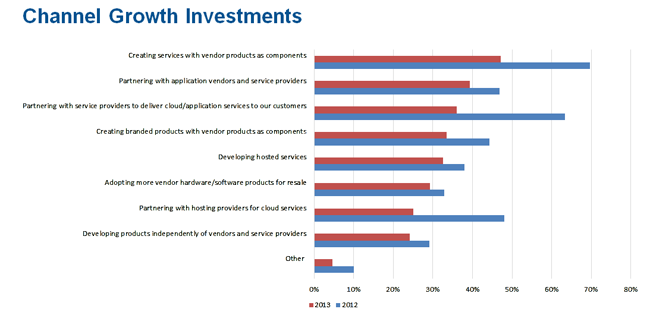

The introspection that comes from advanced planning has also caused some partners to shift tactics when it comes to growing their practices.

According to 2112’s research, solutions providers have reassessed and reprioritized their channel growth efforts to focus on using vendor products to create their own unique, value-added services as well as partnering with other service providers on cloud and applications services (see figure 4). The most notable shift in the channel’s efforts toward growth is the relative abandonment of partnerships with hosting providers for cloud offerings. The cloud host relationships were featured prominently as growth drivers in similar research in 2012, but fell to seventh place in the priority list this year with just 24 percent of respondents continuing to rely on them for market traction.

Fig. 4 (Click image to view full size)

While the results of the 2014 Channel Forecast report are mostly encouraging for solutions providers and the vendors who supply them, the data shows that work remains to be done. Nearly every solutions provider says they want to grow, either in terms of revenues or in capabilities; the reality, however, is that a fair number are still stagnating.

Too many solutions providers appear to have plateaued in low-growth categories that hover at or below an acceptable rate of revenue growth we estimate 16 to 20 percent per year. And while the overall business acumen of partners appears to be improving, the number of solutions providers engaging in meaningful strategic businesses planning is still too low to create a thriving partner ecosystem. In fact, the difference in the percentage of partners championing strategic business planning and the percentage of those actually doing it has increased year over year.

Solutions providers need to raise their expectations for what constitutes sustainable annual revenue growth, and they need to take more aggressive steps to assess their actions and fine tune their sales and marketing efforts in order to achieve their goals. Only through continued focus and measured improvement will the channel realize its full potential as an extender of sales capacity, market reach, and customer relationships that vendors want.

For a copy of the 2014 Channel Forecast report or more information about 2112 research, please visit www.the2112group.com/research.