A Shift In The VAR Business Model To Account For Convergence

By Seth Woodward, Sales Enablement Specialist, TBI

Every industry is being affected by the convergence of technology in the marketplace as offerings broaden and shift to delivery as a service. According to Harvard Business Review, “IT-Driven innovation is reshaping industries and redrawing the lines of competitive rivalry.” Technology companies are rapidly expanding their portfolios through R&D or acquisition to provide new services to their clients. Facebook is developing Messenger to become its search platform. Google is architecting a fiber connectivity network. Dell bought EMC to create an end-to-end hardware and software powerhouse. Similarly, convergence is driving the VAR industry as telecom companies incorporate leading routing and security services into their connectivity offerings and now cloud service providers market solutions directly to the end client.

According to a recent Forbes article, VARs that embrace convergence and offer a more complete solution suite to their clients are thriving, even in the midst of a contracting market. Jonathan Belcher, Vice President of Americas Commercial and Partner Sales at Juniper Networks states, “The massive shift to the cloud is changing the landscape for our traditional partners everywhere. Customers are moving purchases away from capital investments and more toward a pay-as-you go model. To stay competitive and relevant to their customers, VARs will need to bundle connectivity to fill a gap and protect themselves from the changing supply chain that is becoming more prevalent today.”

VARs that do not expand risk falling further behind. As convergence increases and competition from the connectivity and cloud providers escalates, VARs also have a tremendous need to expand their business model and competitive advantage in a crowded marketplace. Five key benefits to VARs embracing convergence are: recovering lost revenues, reducing customer churn, developing a stable and predictable cash flow, retaining top talent, and increasing valuation.

Recovering Lost Revenue — Traditionally, VARs have sold compute, storage, routing, and security appliances with an additional service contract, but those revenues have been eroded by the cloud. A Baird Equity Research Technology report indicated, “AWS reaching $10 billion in revenues by 2016 translates into at least $30 to $40 billion lost from the traditional IT market.” The convergence of technology, while responsible for this loss in revenue, also creates the opportunity to respond competitively to both recover lost revenue and grow additional revenue streams. VARs focused on appliance sales can expand their channel toward the connectivity arena to provide the circuits required for these boxes to work — circuits the client may be procuring elsewhere today. Moving toward the application arena, VARs can incorporate cloud-based solutions like UCaaS, managed AWS & Azure, and desktop as a service (DaaS) to recover lost compute and storage revenue.

Reducing Customer Churn — Customer churn falls when VARs sell additional IT services that close the technology loop for their clients. Instead of just refreshing an appliance every five years, a VAR’s channel can service the ongoing management needs of a client’s entire IT environment by partnering with a Managed Service Provider (MSP). Managed services are high-margin sales that require little ongoing attention from the VAR. Partnering with the correct MSP enables VARs to service their clients’ needs for testing network performance, monitoring firewalls, managing hybrid cloud infrastructure, migrating applications to the cloud, outsourcing helpdesk functions and so forth. Once in place, MSP solutions are more difficult for a competitor to displace due to the consultative nature of the sale. It helps that these more encompassing solutions cannot be priced (or shopped) off a line card. Providing a variety of IT services, either directly or through a partner, cements a VAR as a reliable and trusted advisor to its clients.

Improving Cash Flow — Perhaps the greatest long-term benefit to a VAR expanding its channel to include connectivity, cloud-based solutions and managed services is the benefit of residual income. These services are sold on a service contract--typically ranging from 12-60 months with the majority around 36 months in length. These contracts pay commission to the VAR every month they are in place, allowing commission payments from multiple simultaneous or overlapping contracts to stack atop one another to build a large monthly residual income. The Rule of 78s influences the compounding growth of residual income. For example: if a VAR sells services that pay $10,000 in monthly residual commission, and that VAR repeats this performance every month for one year, at the end of one year that VAR would have built a recurring monthly residual income of $780,000.

Retaining Top Talent — Residual revenue models provide stable cash flow that allows for more predictable revenue projections. Likewise, VARs can leverage residual commission in their compensation plans to retain their top talent by allowing them to continually build a base of recurring commissions. Migrating from an upfront to residual commission model for compensation will require investment from VAR leadership to cover traditional upfront commission payments to employees as the company transitions their sales reps to a residual model. At the outset, VARs may need to pay upfront 10-12 months of residual commission to their reps, but will make up the revenue in months 13-36 of an average contract. This strategy is most palatable to mature VARs with a leadership that is willing to reinvest capital into the organization.

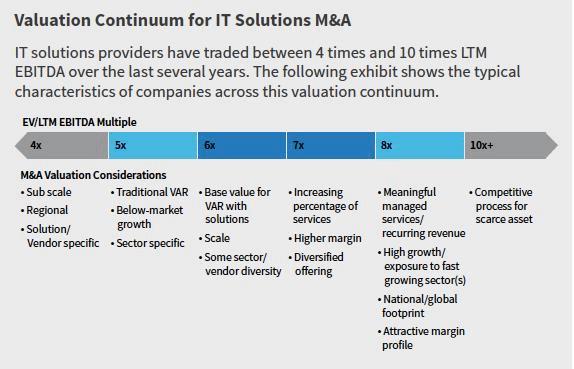

Improving Valuation — Many VARs are owned by Baby Boomers who are anticipating an exit strategy in the next 5-10 years. According to William Blair, traditional VARs whose revenues stem from one-time commission payments with service contracts tacked on (probably with shrinking margins as well) can expect valuations with a 4-6x trailing 12-months’ EBITDA multiple. However, VARs that build a significant residual income base, create strategic relationships with clients, improve their margin structure and diversify their vendor relationships can expect enhanced valuations with a 7-10x trailing 12-months’ EBITDA multiple valuation.

Source: williamblair.com/en/News-Items/2015/December/17/Value-Drivers-and-Valuation-Trends-in-IT-Solutions.aspx

“I meet with partners across the country who have a keen interest in transforming their legacy hardware resell business into a thriving cloud-based recurring revenue model, while at the same time ensuring they maintain account control,” said Belcher. “By offering a path to the cloud through connectivity sales, they now have a positive impact on their own partner valuations as this allows them to generate not only more revenue from their existing customers, but also obtain higher multiples.”

As IT offerings become better defined and expand to cover the entire range from connectivity to the cloud, and as VARs continue to understand the benefits of a recurring or residual revenue model, every constituency will win with the new business model: client end users, client owners, VAR employees and managers and the VAR owners.

Seth Woodward is the Sales Enablement Specialist for TBI, the nation’s leading distributor of technology services – also referred to as a Master Agent. Woodward manages TBI’s portfolio of vendors and develops sales and training initiatives that empower the technology channel to expand services sold to its clients. Previous to TBI, Woodward worked at a technology firm bringing next-gen networking and video solutions to market for national retailers. He is an MBA-candidate at the Kellogg School of Management at Northwestern University.