Capitalize On Digital Signage Demand

By Matt Pillar, Business Solutions magazine.

Increasing demand for interactive digital signs and kiosks creates big opportunities for resellers, but a VAR that’s been there suggests you proceed with caution.

If ever a tech integrator has demonstrated its ability to adapt to the rapidly changing tech landscape, it’s CompUtopia. Case in point: When David and Sojin Lim founded the company in 1983, it sold IBM PCs, Compaq Computers, and products from Franklin Computer Corp., the company that gained infamy for its clones of early Apples. Today, CompUtopia has made its mark as a provider of, among other things, network design and integration, server and desktop virtualization, storage solutions, application development, and Web design services. To talk with Sojin Lim, it’s one of those “other things” that shows great promise for the company this year: digital display and kiosk integration.

In response to increasing demand for interactive digital signage across several of the verticals the company serves, CompUtopia jumped headlong into the market early in 2011. By the end of the year, 10% of the company’s sales were coming from digital signage implementation, a figure Lim expects to grow 100% in 2012. But, this is a cautious tale, filled with Lim’s insight into the hard work a reseller is subject to if digital signage sales success is to be had.

Development Is Key To Display Sales

From the outset of its foray into digital signage sales, CompUtopia sought the development of a comprehensive solution. The worst mistake a digital signage integration company can make is to focus exclusively on hanging the signage, excusing itself of the ongoing content development, distribution, and maintenance of the overall system. For CompUtopia, its operation of a software development division was advantageous. When the market for digital signs ripened, the company had a head start; its development group had been working for some time on a touch interface for HP TouchSmart PCs, an effort it was able to quickly parlay into digital signage and kiosk devices. That differentiator, combined with tight partnerships with hardware (HP) and CMS (content management system) providers such as Scala, ensured that CompUtopia could offer more comprehensive and custom end-to-end systems than the majority of plug and play digital signage integrators.

Today, CompUtopia’s homegrown Interactive Touch Application combines multiple offerings in “carousel” format on a single screen, creating what Lim terms a “dynamic interface that entices the user to come touch and play, then allows them to navigate through layers and layers of information.” The ability to offer custom products and value-added services such as these is of particular importance in digital signage resale, where typical end users (retailers, gaming and entertainment facilities, higher education) can rarely dedicate staff to content development and management. In digital signage, content is king, and measurable success is only possible when the content strategy is clearly defined and consistently executed. Resellers who lack the ability to offer content strategy, development, management, and maintenance are not only risking their end user’s success and the repeat business that comes with it, they’re foregoing the most profitable element of the digital signage equation — recurring revenue through the licensing and value-added management services that “decommoditize” their offering. “Traditional messaging is one level, but dynamic content and touch interactivity is where the market is headed,” says Lim. “Resellers who are only selling displays are missing a great opportunity. A display might sell for $1,000, but the full solution can bump that up to $2,500 per display, with much higher margins.” However, with that opportunity comes complexity. “A digital signage deployment consists of many pieces of information from various parties, including the customer’s management, IT, and marketing teams; hardware providers; and the software and CMS partners, to name a few,” says Lim. “Getting the customer and all parties to a committed decision on the solution it wants can take 10 or more revisions, so it’s not typically a quick sale. Of course, once agreement is achieved, the customer usually wants a highly customized system installed the next week, so there are implementation challenges as well.”

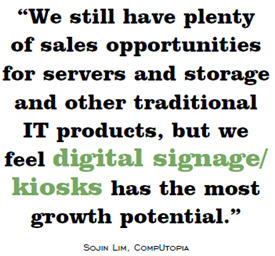

Lim also explains that beyond the advantages of interactivity and self-service, her customers benefit from reporting packages that allow marketers to capture information on consumers’ usage of the displays. “Opportunities like these require deep expertise and high service levels, which creates great sales and margin potential. We still have plenty of sales opportunities for servers and storage and other traditional IT products, but we feel digital signage/kiosks has the most growth potential.” That’s why Lim invested six months of dedicated technical and sales training for digital signage and kiosks. In addition to its dedicated internal training, CompUtopia salespeople and technicians have been trained and certified by its manufacturer partners.

“There are players out there with bundled software, server, and hardware solutions, but those are typically proprietary and expensive,” she says. “We went out to the market, researched it extensively, and hand-selected the hardware, software, and content management pieces that comprise our offering.”

Best Bets For Digital Signage Sales

Investing money, time, and personnel to your company’s development of a modern, networked digital signage solution is a big first step. Your next challenge is finding someone to sell it to. For CompUtopia, casinos have proven a fertile market. “Casinos are complex and dynamic entertainment destinations, with constantly changing special events, concerts, and loyalty promotions that require advertising,” says Lim. “Digital signs complement a casino environment, where printed signs are expensive to create, labor-intensive to hang, and go virtually unnoticed in such an illuminated, visually active environment.” Casinos also are a tight-knit community, where referrals run rampant. Lim says getting a couple of casino accounts under her belt led to a steady stream of word-of-mouth business. But conversion from print to digital advertising isn’t the only thing driving casino business. Lim explains that CompUtopia has been able to win casino business away from proprietary digital signage providers, which charge three to four times more than the typical CompUtopia package. She attributes much of her ability to sell lower-cost, highmargin digital signage networks to her hardware partnership with HP (see sidebar on page 26).

Higher education also has been a successful market for CompUtopia digital signage sales. “Many colleges and universities implemented TVs with some digital signage software years ago. They’re outdated and no longer under warranty, so there’s a large upgrade market opportunity here,” says Lim. “Because colleges and universities are increasingly using these networks for streaming video, advertising, and emergency communication, the market is ripe for a centrally managed digital content management system.” Lim is quick to note that the higher education market is one that has largely avoided the perils of a poor economy — bonded building projects are fueling campus expansions, so CompUtopia sales professionals are diligent about pitching digital signage as core to new construction infrastructure. “Campus construction projects are typically in the planning stages for five years or more before ground is broken, and those planning stages are when budgets are being determined,” advises Lim.

Finally, CompUtopia has its sights set on the quick-serve hospitality market, where digital menu boards provide a quick payback for end users. Daily menu changes are handled more efficiently and cost-effectively with digital menus by eliminating printing and labor costs. Digital menus also allow restaurants to improve their margins through ease of experimentation with menu-pricing strategies and changes.

In any vertical, Lim says the key to sales is often demonstrating the cost savings digital signage will afford in terms of reduced printing and reliance on advertising and creative agencies. “Determine how much the user currently spends on marketing to get the same result,” she says. “Once the framework is set up for digital signage, much of this cost can be eliminated. For one of our major casino customers, the ease of use of the new CMS allowed the marketing director to easily handle what she used to outsource to an ad agency.”

Speaking of advertising agencies, CompUtopia also expects ad revenue to play an increasing role in digital signage demand across verticals. At least one CompUtopia customer, a pet supplies retailer, already leverages its digital signage network to secure marketing funds from pet food manufacturers. “Traditionally, product manufacturers have spent advertising funds on print, television, and radio,” says Lim. “When they extend that advertising to digital display networks in retail, they’re narrowing their exposure more cost-effectively by targeting a very relevant audience that’s very close to the sale,” she says. This is also a popular approach for colleges and universities, which have found success offsetting the cost of their digital display deployments — and even created new revenue streams — by selling advertising to local and national pizza and coffee chains.

The Profit Is In The Preparation

Lim says CompUtopia is enjoying high margins on digital signage because there’s not a lot of competition among resellers for the work right now. “Because these sales are complex and require skills that many resellers don’t possess, we find ourselves competing with either a few niche players or one of the huge AV companies, which aren’t as flexible with back end systems integration as we are.”

With that, Lim cautions that resellers who aren’t willing to commit to learning the complexities of digital signage should avoid the opportunity altogether. “For many resellers, the digital signage space will be too foreign. Gaining competence here is not like becoming certified to sell Microsoft. Beyond technical configuration, the need for multiple providers to pull together creates a whole new set of management challenges associated with determining who’s responsible for what in order to ensure the end user’s success.” As Lim attests, the barriers that stand between most resellers and successful digital signage sales are not small. But then, neither are the rewards for those who do it right.