Service Provider Strategies In A Hybrid IT World

By Al Sadowski, Research Vice President, 451 Research

Over the past 20 years, the hardware layer of infrastructure has mostly commodified, with the value shifting to software and services. This shift means that, to the consumers, the infrastructure itself — the place where logic is processed and data is stored — is less relevant. If it’s secure, compliant, reliable, available on demand, and cost-effective, businesses are generally happy. To the end user, the underlying infrastructure is almost entirely invisible.

Over the past 20 years, the hardware layer of infrastructure has mostly commodified, with the value shifting to software and services. This shift means that, to the consumers, the infrastructure itself — the place where logic is processed and data is stored — is less relevant. If it’s secure, compliant, reliable, available on demand, and cost-effective, businesses are generally happy. To the end user, the underlying infrastructure is almost entirely invisible.

The infrastructure still matters to service providers, however, because their customers are spending more to have those services moved to managed hosting, cloud services, and third-party datacenters — resulting in a hyper-competitive marketplace. This race to stay relevant causes service providers to transform their businesses as much as the enterprises they aid. Automation, scalability, and reliability are now basic necessities for them. Service providers need to increase their agility, ensure secure services, manage costs, and address the ever-evolving list of customer pain points to attract business — making transformation mandatory in the very near future.

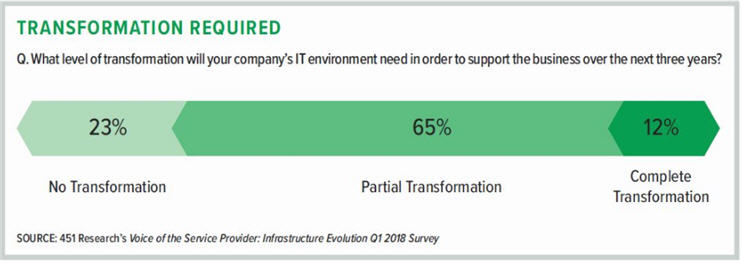

A recent study of service providers by 451 Research — the Voice of the Service Provider survey — found that 77 percent of service providers require some level of IT transformation over the next three years, with MSPs and telcos requiring the most transformation, since these are the business models with the most legacy overhead and the fiercest competition. Colocation providers require partial transformation, as identified by 65 percent of the survey base, as they pivot to offering more than traditional space, power, and access functions. Similar trends appear when looking specifically at systems integrators that are migrating to become MSPs.

There is also a clear desire for simpler storage solutions in terms of deployment, flexibility, and scalability, which is why survey respondents prefer converged and software-defined options to support service-provider hybrid IT endeavors. As such, hardware, software, and services vendors need to rethink their own product road maps, marketing programs, and sales strategies to address the needs of the service providers as they take on this increasingly important role for their customers.

But how far can this market shift go? Spending on traditional IT infrastructure never fully recovered after the 2008 recession, and there are real concerns about the existential threat this presents to a multi-billion-dollar industry that has essentially evolved to support on-premises IT over the last half-century. The lion’s share of infrastructure today remains on-premises, with spending increasingly concentrated among a smaller group of very large IT suppliers. In this sense, it’s still the on-premises providers’ game to lose, especially when service providers are becoming more interested in working with hyperscale cloud providers.

According to the survey, service providers are increasingly turning to public cloud providers for general compute, graphics processing unit (GPU)-based services, and storage resources as on-demand models carry lower risk than capital investment. As such, public cloud services —and the hyperscale providers in particular —continue to define, dominate, and drive the industry’s direction. It is up to the service providers themselves how much of a role these hyperscale providers will play in their strategic planning.

Nonetheless, the hyperscale cloud suppliers—Amazon Web Services, Microsoft, Salesforce, Google, and Alibaba—are gaining greater clarity as they pull away from the pack. The suppliers chasing them are swirling in acquisitions and divestments, going private or breaking up. Every major firm is seeking to respond and reorganize to confront the new market conditions. But even with new niches or pivots, time is not on their side. Most of these players have embraced the inevitable and will provide access to a range of third-party cloud services, in addition to their own, to maintain and expand customer relationships in an increasingly multi-service, hybrid cloud world. Almost without exception, every service provider—hyperscalers aside, of course — will therefore become, in some shape or form, a broker of cloud services.

LOOKING AHEAD: SERVICE PROVIDER SPECIALIZATION REQUIRED

Many service providers seek to grow revenue by assisting customers with cloud adoption and associated technology trends such as Big Data, advanced analytics, edge computing, and automation. But instead of trying to compete head-to-head with the hyperscalers, these service providers aim to work collaboratively with them, burnishing their multi-cloud stories while shifting their own focus from infrastructure services to platform services.

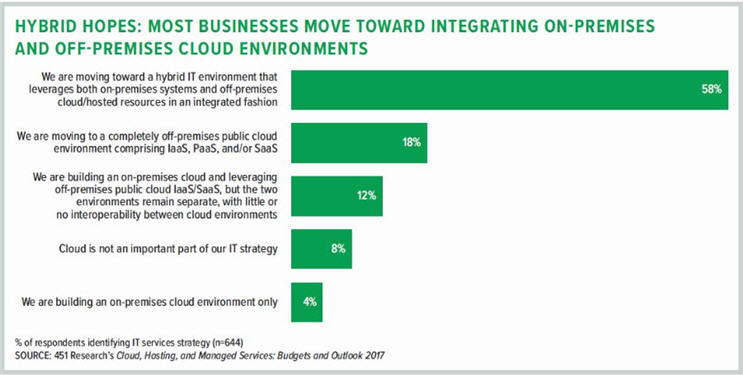

Of course cloud practitioners want to remain in control of their destiny by deploying their own cloud management stacks. But they are now more open to the idea of supporting customers who want to deploy commercial cloud management tools, as well as those who want to run existing internal systems alongside their cloud resources. According to 451 Research data, 58 percent of enterprises are moving toward a hybrid IT environment that leverages both on-premises systems and off-premises cloud resources in an integrated fashion. Only 4 percent of enterprise organizations are building an on-premises cloud for all workloads.

Increasingly, cloud service integrators will move beyond infrastructure, developing their own value-add-ed software assets and investing in open platforms that enable them to operate within wider ecosystems. Managed services providers, to create competitive differentiation and meet customer demands, will have to become more specialized — either by developing special skills and focusing on specific technologies, or by focusing on specific vertical markets.

Services that will become increasingly necessary going forward include lifecycle support and management, ranging from design and deployment to operational management and monitoring. For MSPs, the ability to provide virtual IT management — effectively acting as a virtual CIO by providing high-quality, user-focused services — will be their chief differentiator.

Further out, consultants and systems integrators will likely be in a better position to offer digitized business services using their own assets, but closely integrated with the customer’s established ecosystem of providers — transforming themselves into service partners that can deliver project-oriented tasks or processes that fit within end-to-end business approaches.

And as consultancies take on this system/service integration role, helped by advances in IT automation technology, the classic systems integrators, with their large offshore teams, will begin to consolidate as a means to survive. There will also be a growing risk profile to confront. As major auditing scandals come to light, the management consultancies will be forced to reduce their exposure when providing digitized business services. This could give the struggling systems integrators a new lease on life as the consultancies offload service lines to them.

What is most clear, according to the data, is that service providers are becoming a more important constituency for the technology vendors. To their customers, the service providers prove to be an invaluable business resource, and they are expanding on those relationships. Technology vendors, thus, have numerous opportunities ahead. For now on-premises infrastructure is still dominant in the market, so there is time for technology vendors to shift their product road maps and marketing and sales strategies to offer more appealing products or services for service providers. Better understanding the service provider landscape enables technology vendors to become that premium strategic partner that service providers desire.

451 Research’s Voice of the Service Provider survey leverages a decision maker panel comprising infrastructure- based public cloud providers, hosters, MSPs, telcos, systems integrators, SaaS vendors, and colocation providers in order to quantify and qualify service providers’ pain points, infrastructure buying behaviors, competitive differentiation, and plans for emerging technologies.

AL SADOWSKI focuses on tracking and analyzing services provider adoption of emerging infrastructure, spanning compute, storage, networking, and software- defined infrastructure. He regularly advises the vendor and services provider C-suite, investment bankers, and enterprise CIOs on the business problems that technology attempts to solve.