The Sales Quota Equation for MSPs Capturing MRR

By Nick Heddy, VP of Sales, Pax8

As a business owner, cash flow is something you watch like a hawk. Every investment needs to be calculated. Meaning, it’s absolutely essential to understand how long it’s going to take you to turn a profit on a newly acquired customer.

Unfortunately, a Monthly Recurring Revenue (MRR) model can throw a wrench in the common equations used to determine how much sales quota your business can afford.

That’s why I’m going to share 2 simple equations that make determining your MRR sales quota and payback period easy as 1, 2, 3. Here we go:

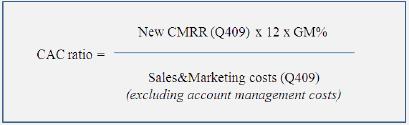

1. Bessemer’s CAC Equation for MRR Companies

Here’s their equation:

Image source: Bessemer’s Top 10 Laws of Cloud Computing and SaaS, Winter 2010

Now, if your brain just went into information overload and you’re about to click away, hold on! There’s a payoff, I promise. Here’s the gist of Bessemer’s equation …

To find the total amount of CAC you’ll earn back in your first year:

- Take the new net annual recurring revenue (let’s say it’s $50,000 per year)

- Then multiply that number by your Gross Margin percentage (let’s assume it’s 40%)

- Divide that $20,000 by the total sales and marketing costs (let’s say it’s $25,000)

- That’s $20,000 / $25,000 = .8

Meaning, you’ll recoup 80% of your CAC in the first year of MRR with the customer. According to Bessemer, that’s a pretty impressive payback rate. Anything that takes 3+ years to pay back should be avoided, but anything below that could be well worth the investment.

As an emerging MSP, you must spend ahead of the curve, and try to pay yourself back in under 24 months. Then, when you become more efficient and get further into your company’s life cycle, strive for 12 months.

2. Sales Commission Equation

Aim to maintain a 6-month payback on sales compensation.

To find out how you’re tracking:

- Take your sales rep’s base salary + their target variable compensation to get their total On Target Earnings (OTE)

- Divide that by 12 to get the monthly cost of the employee

- Then divide the monthly cost by 6 for the estimated payback period (examples below)

In just 3 easy steps, you’ll have the sales quota portion of your MRR model figured out. But keep in mind, that this target is Net Monthly Recurring Revenue (or profit after cost).

|

Base |

Variable |

On Target Earnings |

OTE/12 |

6 Mos. Payback |

|

35,000 |

24,000 |

$59,000 |

$4,917 |

$819 |

|

45,000 |

36,000 |

$81,000 |

$6,750 |

$1,125 |

|

55,000 |

55,000 |

$110,000 |

$9,167 |

$1,528 |

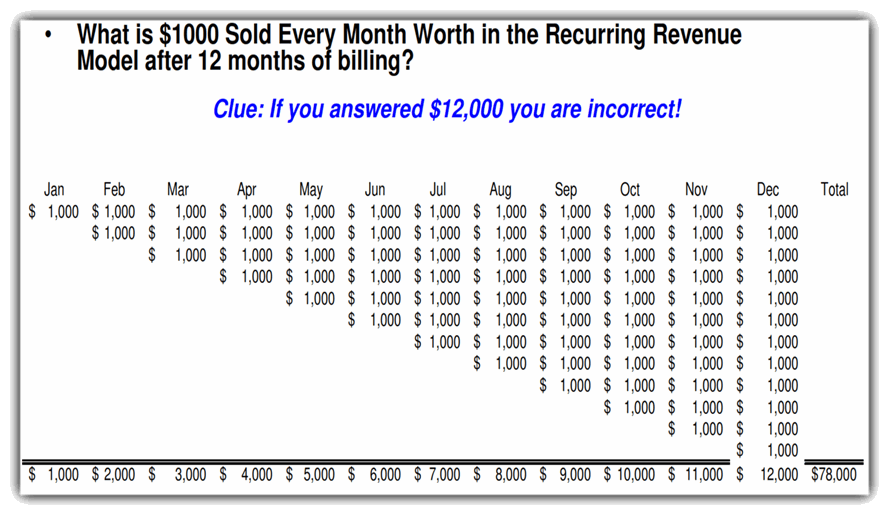

While this might sound like a long time to get your payback, you must also keep in mind the rule of 78s. This means if your sales person hits their target quota every single month over the course of a year, you make a factor of 78 like so:

If you play your cards right, an MRR model can turn into a very profitable long-term business venture. Additional benefits of this model include:

- No impending event to shop the competition

- Increased customer loyalty

- Fewer purchase approvals needed since the cost is spread out

- No renewals or renewals team required

To learn more about Pax8, call (855) 884-PAX8, email info@pax8.com, or visit www.pax8.com.